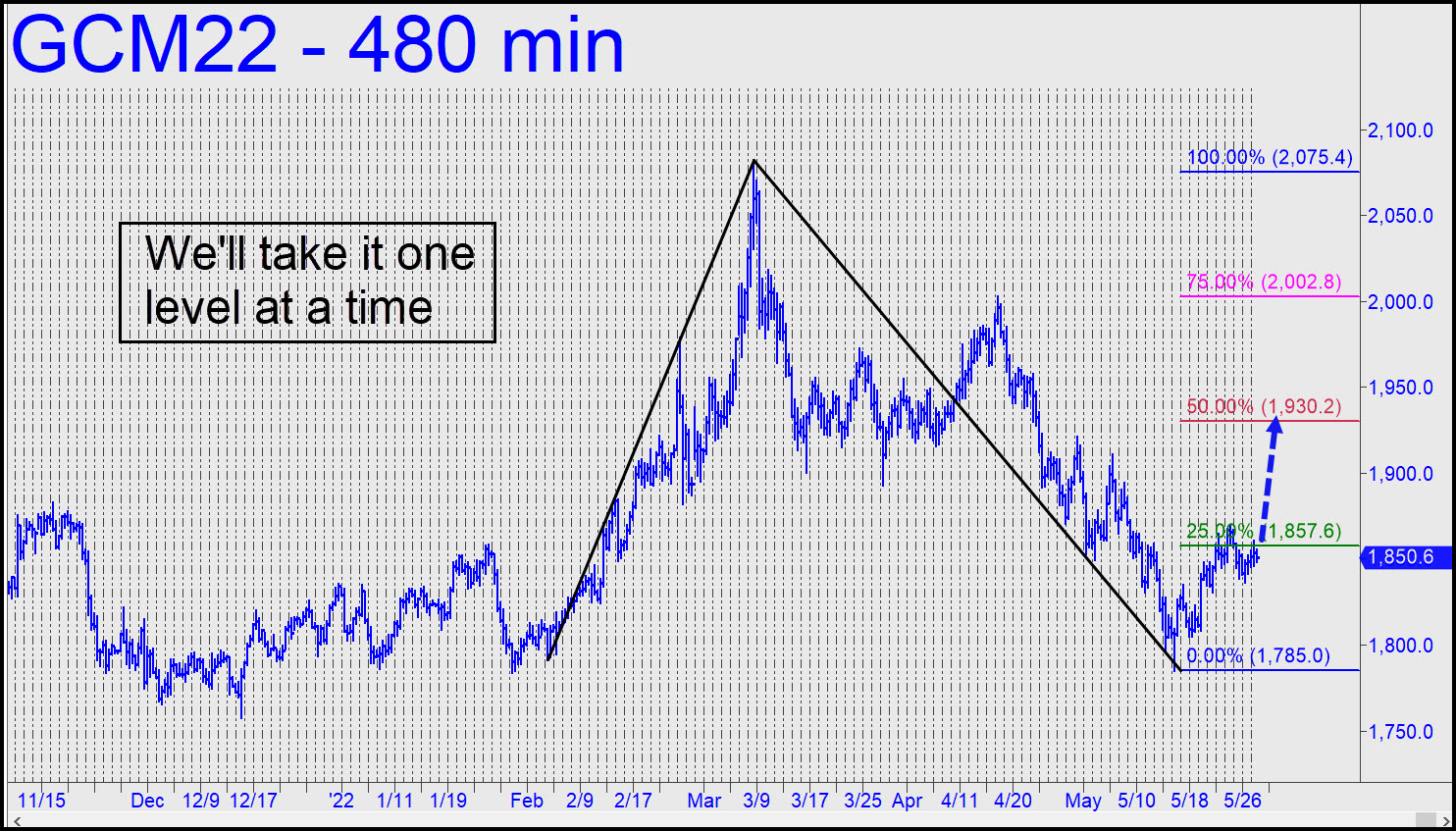

The most bullish thing you could say about this sack of cement is that the May 16 low at 1785.00 did not quite reach its ‘D’ target. That’s why I am returning to a big-picture pattern that is bullish, even if its ‘D’ target at 2075.41 greatly exceeds our expectations at the moment. A theoretical ‘buy’ that triggered last week implies a rally over the next 5-7 days to p=1930.20, the pattern’s midpoint Hidden Pivot. We’ll be better able to judge whether the move is likely to hit D once we’ve seen buyers interact with that number. If it is impaled on first contact or the futures close above it for two consecutive days, that would shorten the odds of a continuation to 2075. ______ UPDATE: (May 31, 10:39 p.m.): Today’s funereal price action raises the question of whether the future can even reach the midpoint pivot, let alone interact with it. The theoretical buy signal is still in effect, although there is no good reason to actualize it. The good news is that gold will rally, although not too far, once we have become despairing of the possibility.

The most bullish thing you could say about this sack of cement is that the May 16 low at 1785.00 did not quite reach its ‘D’ target. That’s why I am returning to a big-picture pattern that is bullish, even if its ‘D’ target at 2075.41 greatly exceeds our expectations at the moment. A theoretical ‘buy’ that triggered last week implies a rally over the next 5-7 days to p=1930.20, the pattern’s midpoint Hidden Pivot. We’ll be better able to judge whether the move is likely to hit D once we’ve seen buyers interact with that number. If it is impaled on first contact or the futures close above it for two consecutive days, that would shorten the odds of a continuation to 2075. ______ UPDATE: (May 31, 10:39 p.m.): Today’s funereal price action raises the question of whether the future can even reach the midpoint pivot, let alone interact with it. The theoretical buy signal is still in effect, although there is no good reason to actualize it. The good news is that gold will rally, although not too far, once we have become despairing of the possibility.

GCM22 – June Gold (Last:1831.70)