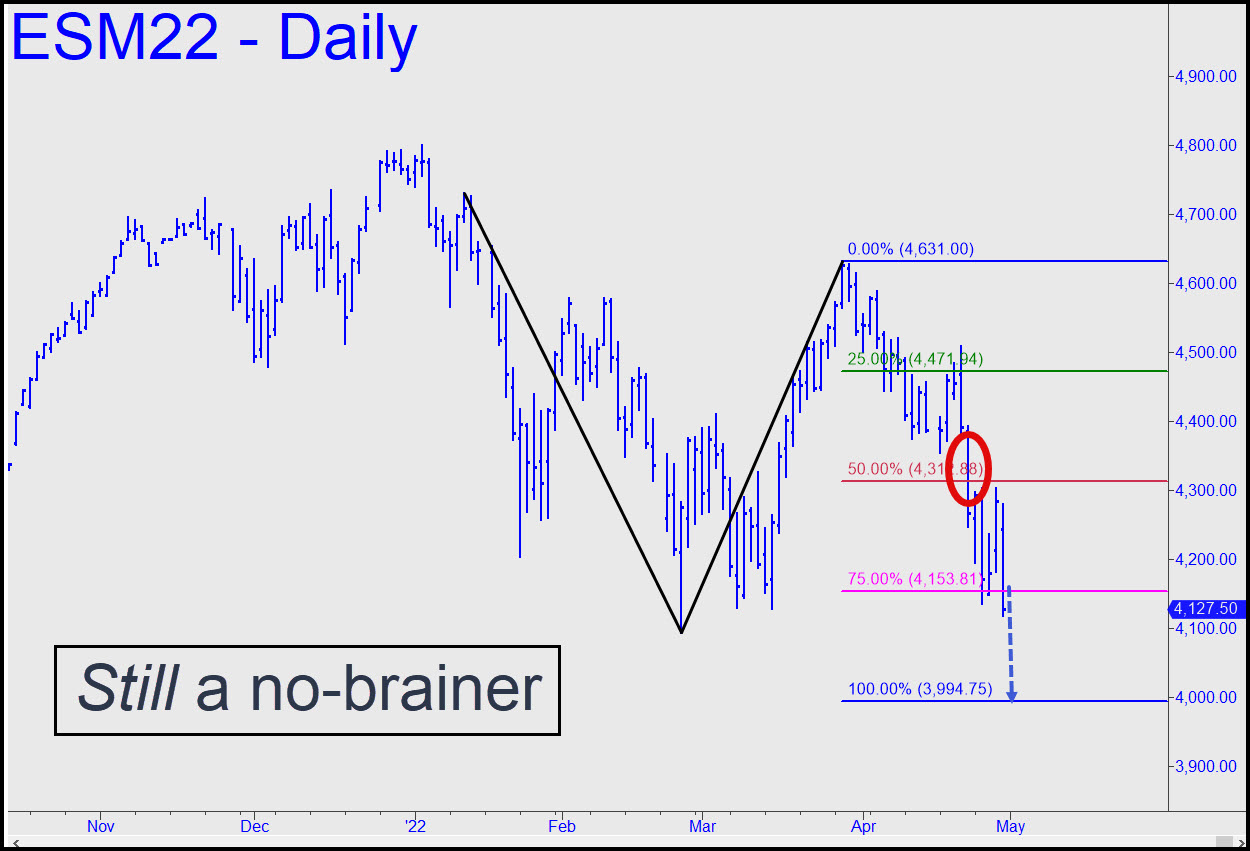

The pattern in the chart replicates the one displayed here last week, but with an additional, plunging bar that shows why the once-outrageous target at 3994.75 remains a lock-up. We confidently assumed it would be reached when sellers obliterated the pattern’s 4312 midpoint support a little more than a week ago. On Friday, they wrecked another Hidden Pivot, the 4146 ‘D’ target of a lesser pattern, all but clinching more downside to D=3994.75. The pattern is too obvious to suggest that bottom-fishing with the usual nickel-and-dime stop-loss will be easy, but even so, there is no way in hell the futures will not rebound tradeably from somewhere very close to the target. Shorting corrective peaks will be yet more difficult, although nothing we can’t handle with some diligent crowdsourcing in the Trading Room. _____ UPDATE (May 3, 10:35 p.m.): The pattern shown is a fine specimen of my favorite kind of gnarliness, which explains why it produced several ‘mechanical’ winners during today’s session. If you made money on the long side, use some of it to cushion a stop-loss shorting at D=4210.25. You’ll be on your on if the order fills. _______ UPDATE (May 4, 10:36 p.m.): If you’re eager to get short — as who on Earth is not? – fixate on the dotted red line I’ve drawn at 4401.75 as a place to set it up. This is the sweet spot of the ‘discomfort zone’ we love to use, and although it lies an impressive leap above current levels, it shouldn’t prove too difficult for DaScumballs to achieve. They drilled shorts a new orifice today, then strung them up with piano wire and left them hanging a millimeter from last week’s peak. This is how powerful rallies happen with zero bullish buying, and we should always be careful about underestimating such effusions as the Mother of All Bear Markets continues to evolve. _______ UPDATE (May 5, 9:24 p.m.): Thursday’s 250-point short squeeze has given way to an equally gratuitous 200-point decline. It did not affect the viability of our 3994.75 downside target, although it did demonstrate how very difficult it can be to get short and stay short in a bear market.

The pattern in the chart replicates the one displayed here last week, but with an additional, plunging bar that shows why the once-outrageous target at 3994.75 remains a lock-up. We confidently assumed it would be reached when sellers obliterated the pattern’s 4312 midpoint support a little more than a week ago. On Friday, they wrecked another Hidden Pivot, the 4146 ‘D’ target of a lesser pattern, all but clinching more downside to D=3994.75. The pattern is too obvious to suggest that bottom-fishing with the usual nickel-and-dime stop-loss will be easy, but even so, there is no way in hell the futures will not rebound tradeably from somewhere very close to the target. Shorting corrective peaks will be yet more difficult, although nothing we can’t handle with some diligent crowdsourcing in the Trading Room. _____ UPDATE (May 3, 10:35 p.m.): The pattern shown is a fine specimen of my favorite kind of gnarliness, which explains why it produced several ‘mechanical’ winners during today’s session. If you made money on the long side, use some of it to cushion a stop-loss shorting at D=4210.25. You’ll be on your on if the order fills. _______ UPDATE (May 4, 10:36 p.m.): If you’re eager to get short — as who on Earth is not? – fixate on the dotted red line I’ve drawn at 4401.75 as a place to set it up. This is the sweet spot of the ‘discomfort zone’ we love to use, and although it lies an impressive leap above current levels, it shouldn’t prove too difficult for DaScumballs to achieve. They drilled shorts a new orifice today, then strung them up with piano wire and left them hanging a millimeter from last week’s peak. This is how powerful rallies happen with zero bullish buying, and we should always be careful about underestimating such effusions as the Mother of All Bear Markets continues to evolve. _______ UPDATE (May 5, 9:24 p.m.): Thursday’s 250-point short squeeze has given way to an equally gratuitous 200-point decline. It did not affect the viability of our 3994.75 downside target, although it did demonstrate how very difficult it can be to get short and stay short in a bear market.

ESM22 – June E-Mini S&Ps (Last:4129.25)