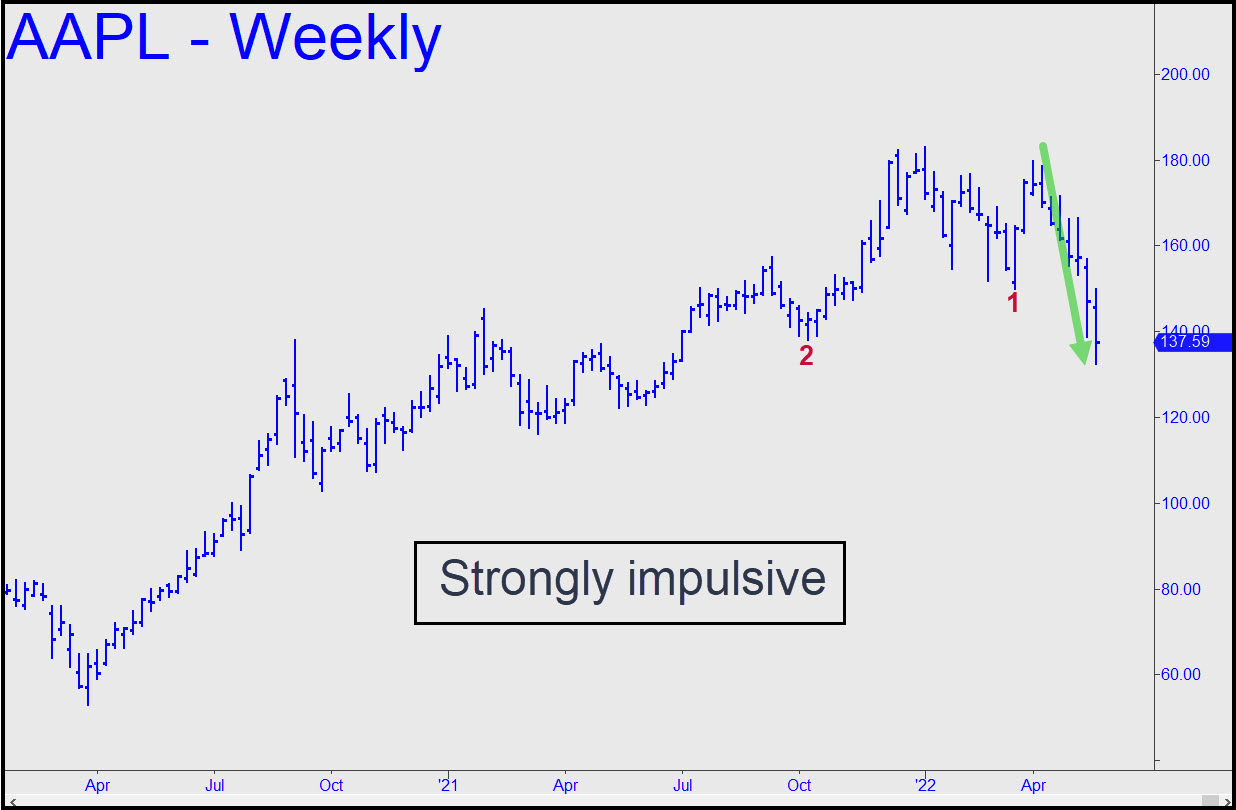

Last week’s plunge generated an impulse leg of weekly-chart degree, implying that any rally will be merely corrective and an opportunity to restock short positions. The bounce came off a low less than a dollar from the 131.81 target we’d been using to nail the bottom. The pattern in retrospect was far too obvious to have worked as precisely as we’ve come to expect. Increasingly gnarly ABCD patterns will continue to serve us for trading and forecasting purposes, but it’s clear that the whole world is now front-running obvious targets. Looking just ahead, AAPL would need to pop above 141.56 to become impulsively bullish on the hourly chart. ______ UPDATE (May 23, 8:22 p.m.): The stock is headed most immediately for the 145.96 target shown in this chart. There have been no pullbacks sufficient to trigger a ‘mechanical buy, but the pattern is gnarly enough to produce profitable results no matter how you use it. ______ UPDATE (May 24, 9:57 p.m.): Buyers failed so miserably to fulfill the promise of the bullish pattern linked above that AAPL could weigh on the market Wednesday. Let’s move to the sidelines for now. _______ UPDATE (May 26, 5:56 p.m.): This time it was the stock market dragging a punk-looking AAPL higher rather than the other way around. If the stock gets in gear, the broad averages look primed to soar.

Last week’s plunge generated an impulse leg of weekly-chart degree, implying that any rally will be merely corrective and an opportunity to restock short positions. The bounce came off a low less than a dollar from the 131.81 target we’d been using to nail the bottom. The pattern in retrospect was far too obvious to have worked as precisely as we’ve come to expect. Increasingly gnarly ABCD patterns will continue to serve us for trading and forecasting purposes, but it’s clear that the whole world is now front-running obvious targets. Looking just ahead, AAPL would need to pop above 141.56 to become impulsively bullish on the hourly chart. ______ UPDATE (May 23, 8:22 p.m.): The stock is headed most immediately for the 145.96 target shown in this chart. There have been no pullbacks sufficient to trigger a ‘mechanical buy, but the pattern is gnarly enough to produce profitable results no matter how you use it. ______ UPDATE (May 24, 9:57 p.m.): Buyers failed so miserably to fulfill the promise of the bullish pattern linked above that AAPL could weigh on the market Wednesday. Let’s move to the sidelines for now. _______ UPDATE (May 26, 5:56 p.m.): This time it was the stock market dragging a punk-looking AAPL higher rather than the other way around. If the stock gets in gear, the broad averages look primed to soar.

AAPL – Apple Computer (Last:143.75)