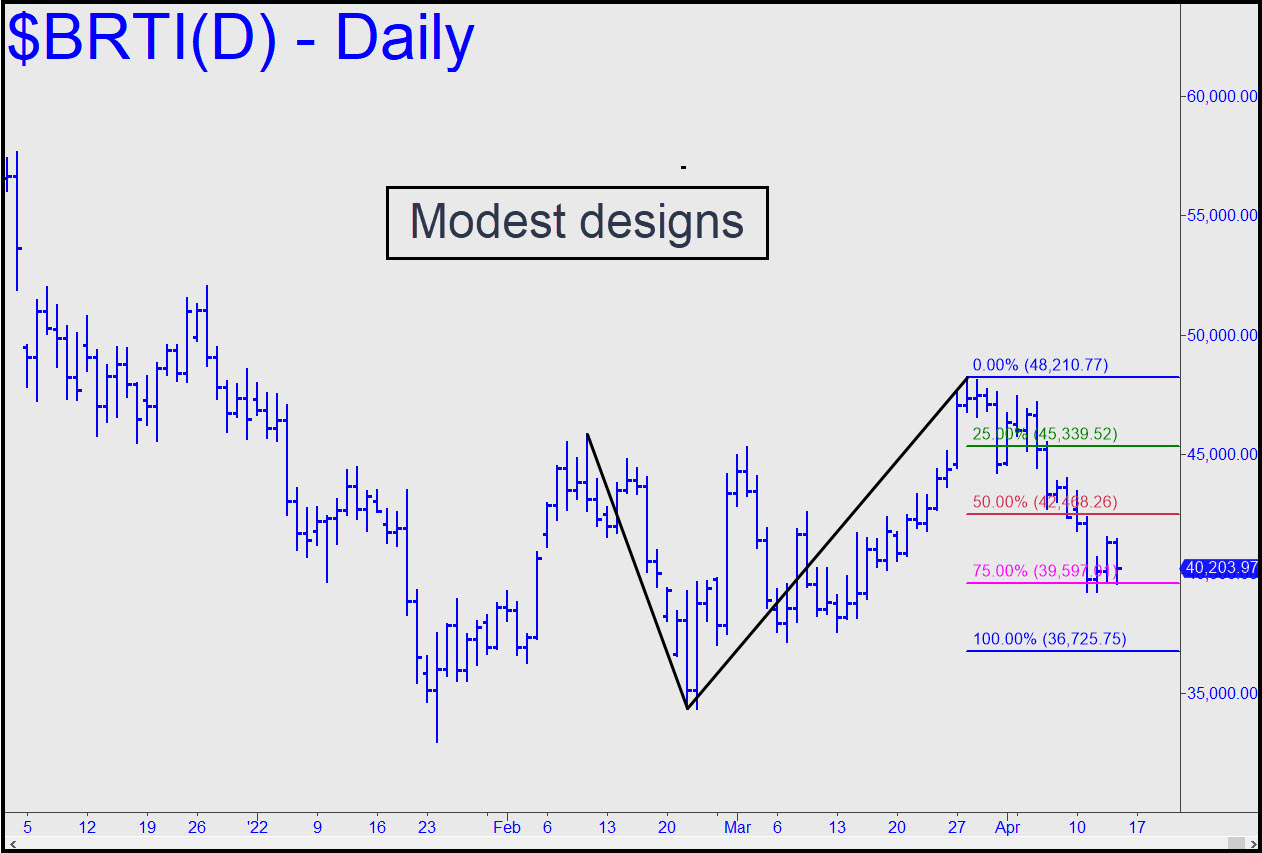

I was going to drop Bertie from the list to see if anyone noticed, but force of habit has cause me to leave it. Rather than stoke your enthusiasm by reminding you of a 61,163 rally target, however, I won’t even highlight this number in green. Instead, I’ll call your attention to the 36,725 target of the corrective patterns shown in the inset. It has yet to gift us with any decent ‘mechanical’ shorts, but I wouldn’t rule out the prospect of bottom-fishing with a ‘counterintuitive’ set-up if and when 36,725 is achieved. The pattern is not so obvious that it should attract much interest from the usual droolers and math majors. ______ UPDATE (Apr 27, 12:06 a.m.): Bertie finally did trip a ‘mechanical’ short on last week’s run-up to 42,468, but, like, who cares, right? _______ UPDATE (May 5, 11:17 a.m.): I just posted the following in the chat room in response to a query about how low bitcoin can go. The 36,725 downside target I’ve been using for bitcoin was the most conservative possible, since it used a relatively small ‘reverse’ pattern to project ‘D’. If and when 36,725 gives way, I would simply switch to the next larger pattern to project a new target. In this case, it is a conventional pattern that projects 29,130 as a likely low. Here’s the chart.

I was going to drop Bertie from the list to see if anyone noticed, but force of habit has cause me to leave it. Rather than stoke your enthusiasm by reminding you of a 61,163 rally target, however, I won’t even highlight this number in green. Instead, I’ll call your attention to the 36,725 target of the corrective patterns shown in the inset. It has yet to gift us with any decent ‘mechanical’ shorts, but I wouldn’t rule out the prospect of bottom-fishing with a ‘counterintuitive’ set-up if and when 36,725 is achieved. The pattern is not so obvious that it should attract much interest from the usual droolers and math majors. ______ UPDATE (Apr 27, 12:06 a.m.): Bertie finally did trip a ‘mechanical’ short on last week’s run-up to 42,468, but, like, who cares, right? _______ UPDATE (May 5, 11:17 a.m.): I just posted the following in the chat room in response to a query about how low bitcoin can go. The 36,725 downside target I’ve been using for bitcoin was the most conservative possible, since it used a relatively small ‘reverse’ pattern to project ‘D’. If and when 36,725 gives way, I would simply switch to the next larger pattern to project a new target. In this case, it is a conventional pattern that projects 29,130 as a likely low. Here’s the chart.

BRTI – CME Bitcoin Index (Last:36,205)