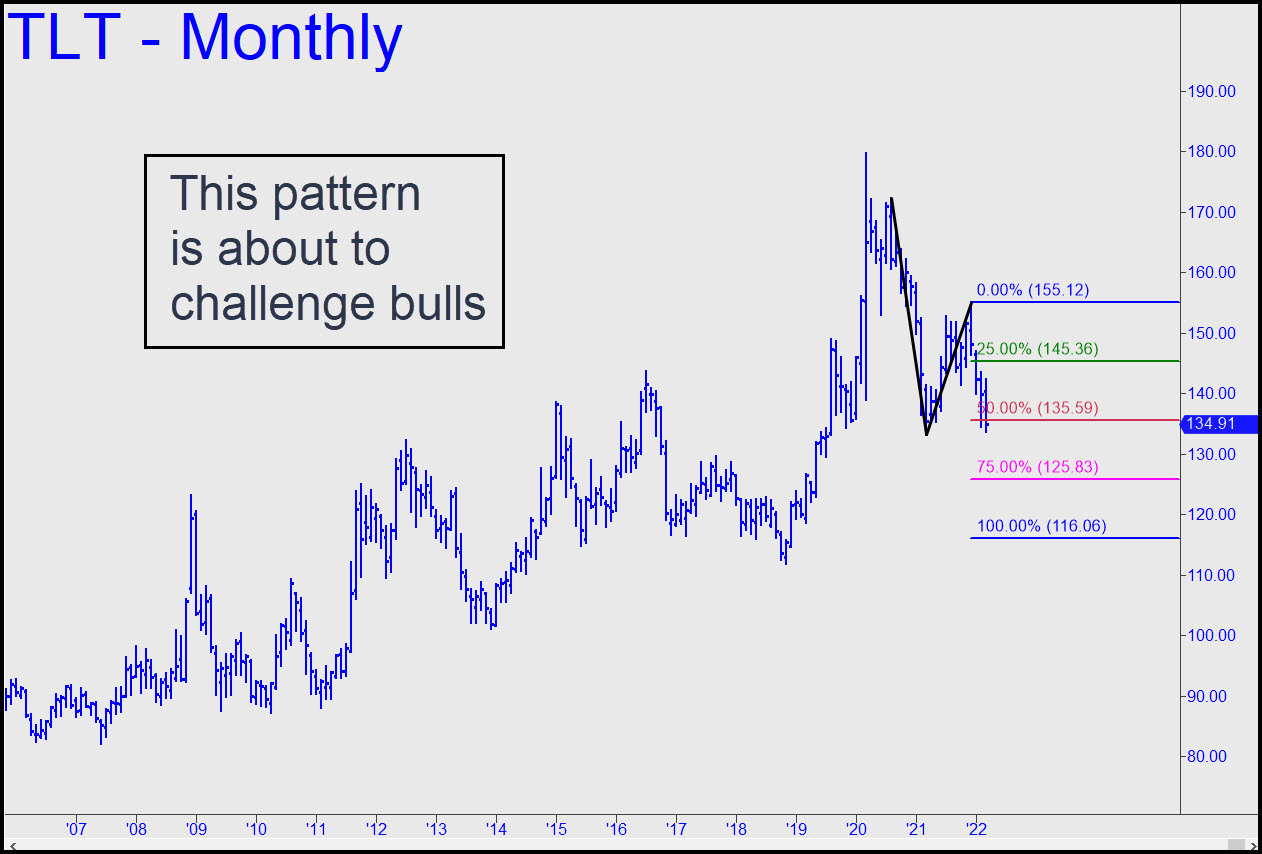

The corrective pattern shown may be too obvious to provide precise hooks for low-risk shorting and/or bottom-fishing, but it is not apt to fail us predictively. To that end, we should continue to monitor price action at p=135.59 closely. So far, the stall at this Hidden Pivot support would seem to suggest that bulls still hold an edge. However, a reversal to the downside, if steep enough, could signal a further retracement to as low as the ‘d’ target at 116.06. For now, and strictly speaking, a rally to the green line (x=145.36) would generate an appealing ‘mechanical’ short. _______ UPDATE (Mar 14, 10:30 p.m.): Sellers overwhelmed the midpoint support at 135.59, implying they will bludgeon this vehicle down to at least p2=125.83.

The corrective pattern shown may be too obvious to provide precise hooks for low-risk shorting and/or bottom-fishing, but it is not apt to fail us predictively. To that end, we should continue to monitor price action at p=135.59 closely. So far, the stall at this Hidden Pivot support would seem to suggest that bulls still hold an edge. However, a reversal to the downside, if steep enough, could signal a further retracement to as low as the ‘d’ target at 116.06. For now, and strictly speaking, a rally to the green line (x=145.36) would generate an appealing ‘mechanical’ short. _______ UPDATE (Mar 14, 10:30 p.m.): Sellers overwhelmed the midpoint support at 135.59, implying they will bludgeon this vehicle down to at least p2=125.83.

TLT – Lehman Bond ETF (Last:134.91)