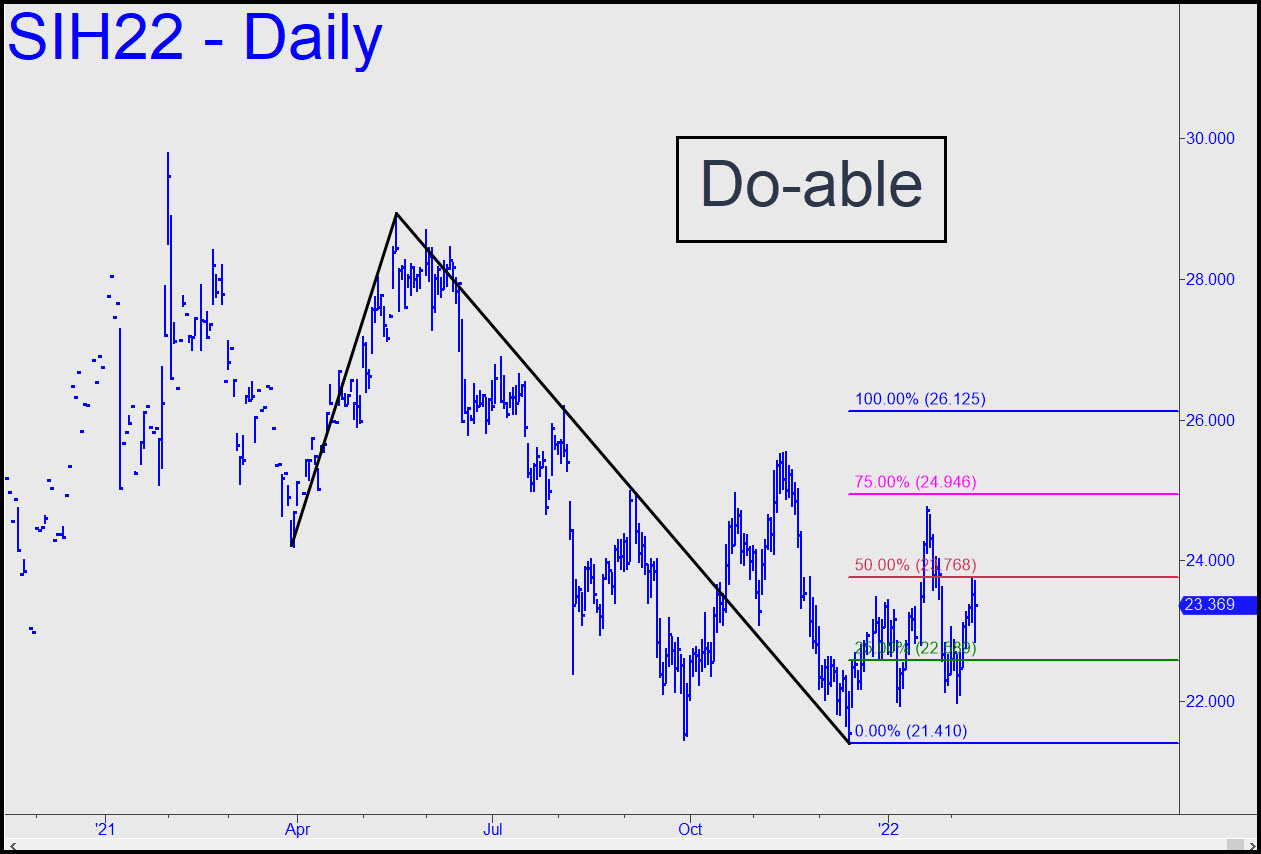

The chart shown uses a slightly more ambitious and gnarlier pattern than my latest one in gold to project a rally target at 26.12. It has yielded a profitable ‘mechanical’ buy, although not as lucrative as the one in gold. However, it should serve in any case to keep us confidently aboard the uptrend for as long as it continues. A second ‘mechanical’ entry could be attempted if the futures revisit the green line (22.59), but I am recommending this only if the implied drop follows a high in the ‘sweet spot’ between p and p2. We should also be alert to a possible resumption of weakness, since there is a downtrending conventional abc pattern that tripped a ‘mechanical’ short on last week’s rally to x=23.72 (Daily chart, A=25.54 on 11/16).

The chart shown uses a slightly more ambitious and gnarlier pattern than my latest one in gold to project a rally target at 26.12. It has yielded a profitable ‘mechanical’ buy, although not as lucrative as the one in gold. However, it should serve in any case to keep us confidently aboard the uptrend for as long as it continues. A second ‘mechanical’ entry could be attempted if the futures revisit the green line (22.59), but I am recommending this only if the implied drop follows a high in the ‘sweet spot’ between p and p2. We should also be alert to a possible resumption of weakness, since there is a downtrending conventional abc pattern that tripped a ‘mechanical’ short on last week’s rally to x=23.72 (Daily chart, A=25.54 on 11/16).

SIH22 – March Silver (Last:23.27)