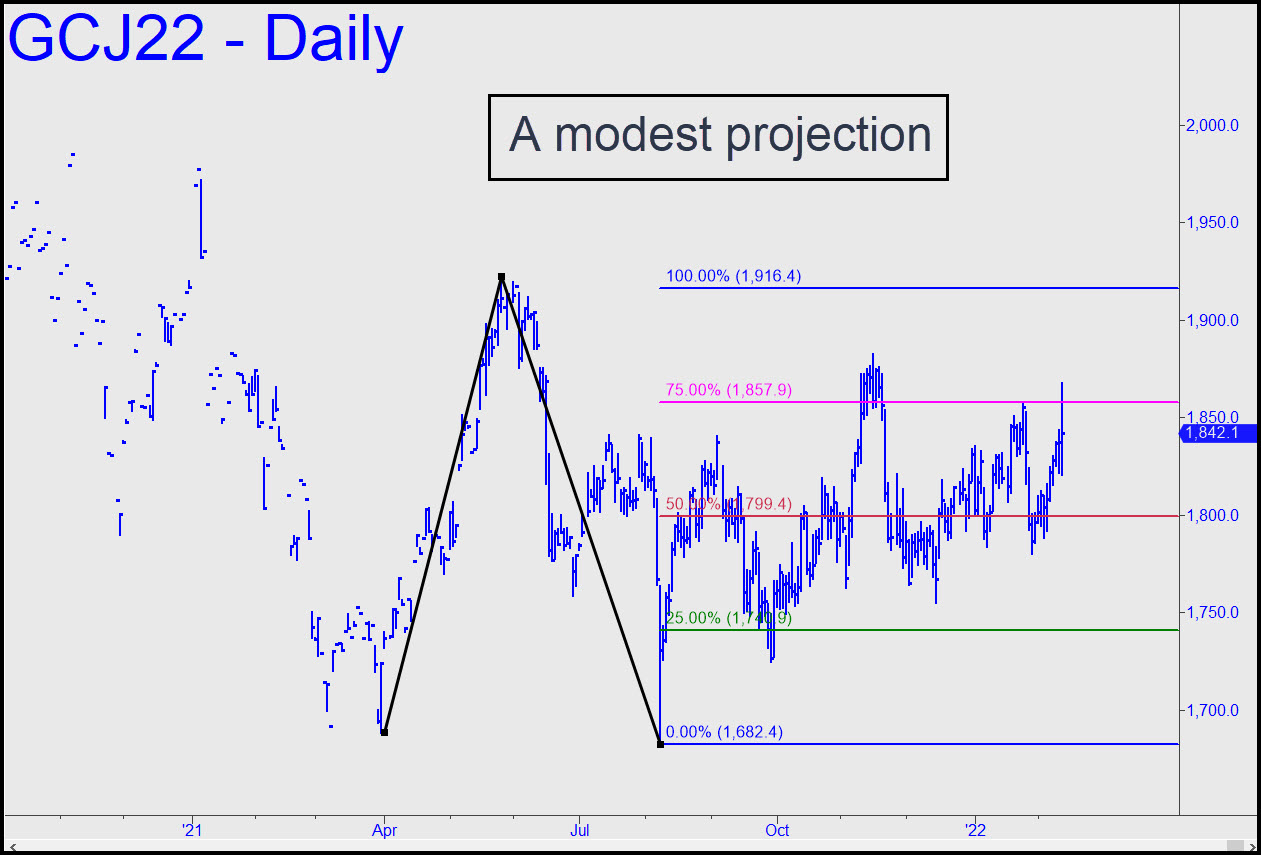

The 1875.10 rally target of a ‘reverse’ pattern tracing back to November remains my minimum upside projection for the near term. The pattern has produced stellar ‘mechanical’ gains for subscribers who used it to get long on the dip to the green line back in October. Looking ahead optimistically, I’ll suggest using the new, larger ‘reverse’ pattern shown to stay with the trend no matter how erratic it becomes. The pattern paradoxically yields a more modest target at 1916.40 than some smaller ones I could have used. However, because this is gold, which so often disappoints, I am being cautious. As always, a decisive move through this Hidden Pivot resistance on first contact would be a welcome sign that the rally has farther to go — perhaps much farther. We shall see. _______ UPDATE (Feb 15, 11:23 p.m.): The rally’s failure by $1 to surpass key peak at 1882.50 recorded in November warrants a cautious outlook. Even if the peak eventually is exceeded, the likelihood of significant upside from there has already decreased. _____ UPDATE (Feb 17, 6:15 p.m.): The futures appear all but certain to achieve the 1916.40 target, which served to keep us confidently on the right side of a balky trend. Let’s see how bulls handle this ‘hidden’ resistance, since an easy move past it would portend a continuation of the uptrend. You can short there with ‘camouflage’ if you’ve made some bucks on the way up.

The 1875.10 rally target of a ‘reverse’ pattern tracing back to November remains my minimum upside projection for the near term. The pattern has produced stellar ‘mechanical’ gains for subscribers who used it to get long on the dip to the green line back in October. Looking ahead optimistically, I’ll suggest using the new, larger ‘reverse’ pattern shown to stay with the trend no matter how erratic it becomes. The pattern paradoxically yields a more modest target at 1916.40 than some smaller ones I could have used. However, because this is gold, which so often disappoints, I am being cautious. As always, a decisive move through this Hidden Pivot resistance on first contact would be a welcome sign that the rally has farther to go — perhaps much farther. We shall see. _______ UPDATE (Feb 15, 11:23 p.m.): The rally’s failure by $1 to surpass key peak at 1882.50 recorded in November warrants a cautious outlook. Even if the peak eventually is exceeded, the likelihood of significant upside from there has already decreased. _____ UPDATE (Feb 17, 6:15 p.m.): The futures appear all but certain to achieve the 1916.40 target, which served to keep us confidently on the right side of a balky trend. Let’s see how bulls handle this ‘hidden’ resistance, since an easy move past it would portend a continuation of the uptrend. You can short there with ‘camouflage’ if you’ve made some bucks on the way up.

GCJ22 – April Gold (Last:1901.30)