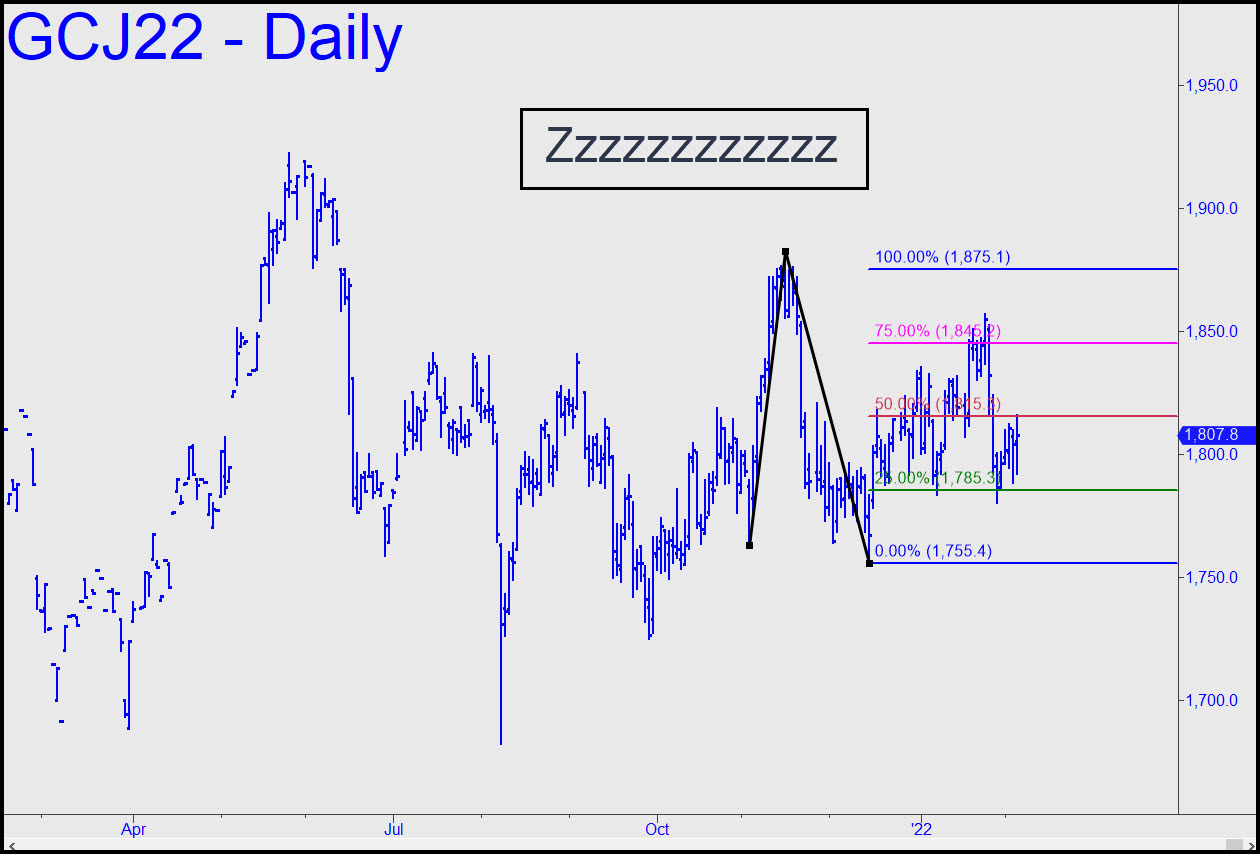

The marginally bearish pattern shown here last week obscured a marginally bullish one that put April Gold on a ‘mechanical’ buy signal. It was triggered a week ago when the futures came down to the green line (x=1785.90). The position would have produced a theoretical profit on four contracts of $12,000 on Friday, when a weak rally touched the red line where partial profit-taking would have been in order. All of this has little to tell us about gold’s next move, but we shouldn’t expect too much, given the tedium of the last ten months. _______ UPDATE (Feb 9, 8:31 p.m. EST): We can continue to use this pattern to get a precise handle on gold, since the ‘mechanical’ buy signal it generated two weeks ago is still live and very profitable, at least in theory. The story will become more interesting if bulls blow past D=1875.10, but I wouldn’t count too heavily on it. In the meantime, a pullback from p2 to p once the higher pivot is touched could be ‘mechanically’ tradeable.

The marginally bearish pattern shown here last week obscured a marginally bullish one that put April Gold on a ‘mechanical’ buy signal. It was triggered a week ago when the futures came down to the green line (x=1785.90). The position would have produced a theoretical profit on four contracts of $12,000 on Friday, when a weak rally touched the red line where partial profit-taking would have been in order. All of this has little to tell us about gold’s next move, but we shouldn’t expect too much, given the tedium of the last ten months. _______ UPDATE (Feb 9, 8:31 p.m. EST): We can continue to use this pattern to get a precise handle on gold, since the ‘mechanical’ buy signal it generated two weeks ago is still live and very profitable, at least in theory. The story will become more interesting if bulls blow past D=1875.10, but I wouldn’t count too heavily on it. In the meantime, a pullback from p2 to p once the higher pivot is touched could be ‘mechanically’ tradeable.

GCJ22 – April Gold (Last:1834.20)