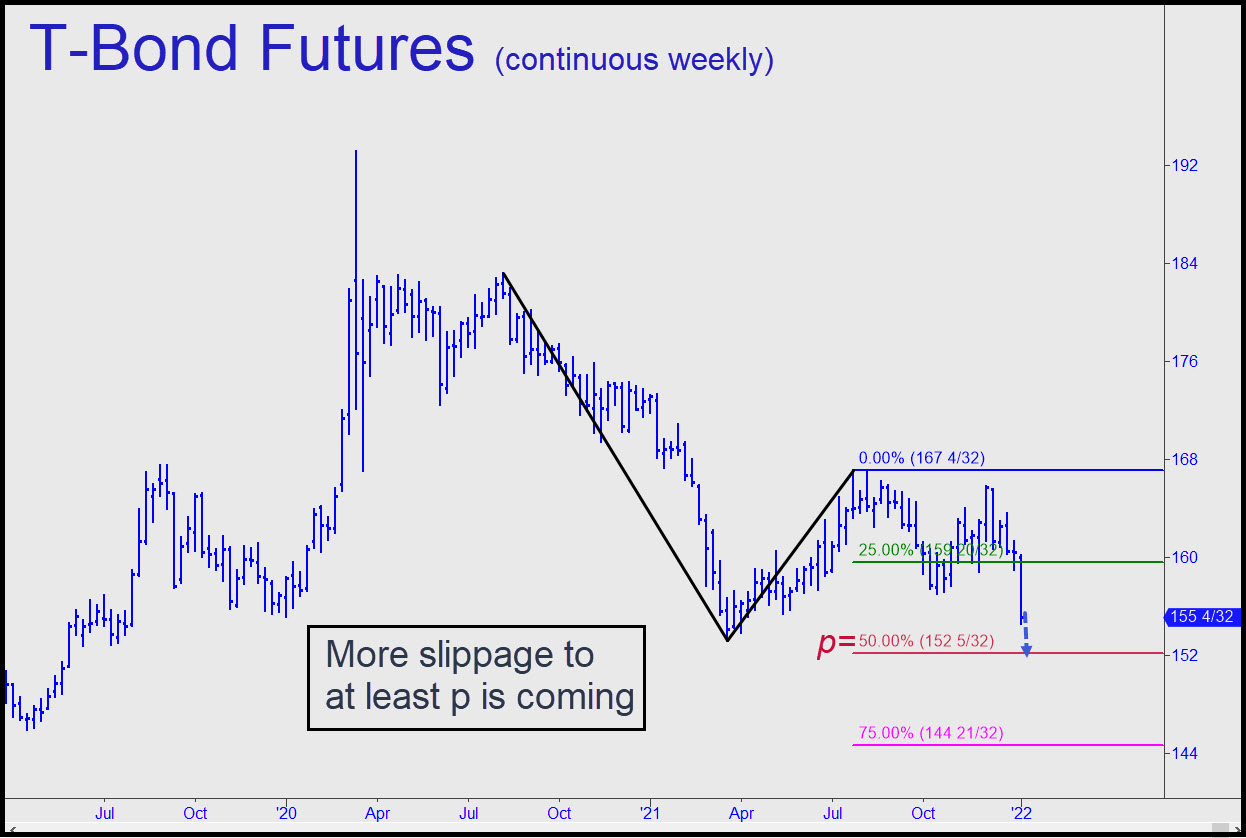

The March contract struggled for a foothold all week and now looks likely to continue lower to at least p=152^05. A tradeable reversal at or very near this Hidden Pivot midpoint support is predictable, and bottom-fishing there will undoubtedly be easier than attempting to short the downtrend. Not that we can’t try, but let’s plan on using TLT for this task, and for bottom-fishing as well if preferred, since it’s a cheaper way to play. In the unlikely event that sellers crush the red line, the secondary pivot (p2) at 144^21 would be in play. _______ UPDATE (Jan 11, 8:33 p.m.): The pattern shown here is too gnarly not to work in every possible way, so don’t hesitate to try tightly stopped bottom-fishing if the futures swoon to x=155^20. Sideways action this evening appears to be a consolidation for a push to D=156^21. However high it goes, the rally will be corrective. ______ UPDATE (Jan 12, 5:16 p.m.): The futures fell to 155^21, missing our bid by a single tick before rallying moderately into the close. We’ll just watch, since I am not recommending buying a relapse that touches the green line. _______ UPDATE (Jan 13, 8:56 p.m.): Today’s spike exceeded the 156^21 target by seven ticks, enough to earn the uptrend the begrudging benefit of the doubt at least for the time being. _______ UPDATE (Jan 16, 4:21 p.m.): So much for the benefit of the doubt. T-Bonds are way overdue for a bounce, but if last week’s little dribbler is the best bulls can do, yields are going higher, and the blithe idiots who have been pumping stocks will eventually have to pay heed. _______ UPDATE (Jan 19, 10:58 p.m.): A rally to x=155^12 would trigger an appealing ‘mechanical’ short. This trade is only for subscribers who understand why ‘x’ is not a support, resistance or a Hidden Pivot. _______ UPDATE (Jan 20, 8:05 p.m.): A vertical spike has hit 155^12 this evening, cueing up the short noted above. On the 15-minute chart, use a reverse pattern where a= 154^19 (Jan 19, at 2:30 p.m. EST) to create an entry trigger. Your theoretical risk initially would be about $250/contract. You’ll be on your own if the expected downturn hits the first profit-taking threshold at 154^30. _______ UPDATE (Jan 21, 9:31): The trade triggered twice last night, and one European subscriber reported exiting in the middle of New York’s night with a profit. However, I’ll record this one as a scratch, with no gain or loss, since it took guts, savvy and agility to manage the trade. All of it had to have been covered at the red line, since a subsequent rally pushed the futures to new recovery highs.

The March contract struggled for a foothold all week and now looks likely to continue lower to at least p=152^05. A tradeable reversal at or very near this Hidden Pivot midpoint support is predictable, and bottom-fishing there will undoubtedly be easier than attempting to short the downtrend. Not that we can’t try, but let’s plan on using TLT for this task, and for bottom-fishing as well if preferred, since it’s a cheaper way to play. In the unlikely event that sellers crush the red line, the secondary pivot (p2) at 144^21 would be in play. _______ UPDATE (Jan 11, 8:33 p.m.): The pattern shown here is too gnarly not to work in every possible way, so don’t hesitate to try tightly stopped bottom-fishing if the futures swoon to x=155^20. Sideways action this evening appears to be a consolidation for a push to D=156^21. However high it goes, the rally will be corrective. ______ UPDATE (Jan 12, 5:16 p.m.): The futures fell to 155^21, missing our bid by a single tick before rallying moderately into the close. We’ll just watch, since I am not recommending buying a relapse that touches the green line. _______ UPDATE (Jan 13, 8:56 p.m.): Today’s spike exceeded the 156^21 target by seven ticks, enough to earn the uptrend the begrudging benefit of the doubt at least for the time being. _______ UPDATE (Jan 16, 4:21 p.m.): So much for the benefit of the doubt. T-Bonds are way overdue for a bounce, but if last week’s little dribbler is the best bulls can do, yields are going higher, and the blithe idiots who have been pumping stocks will eventually have to pay heed. _______ UPDATE (Jan 19, 10:58 p.m.): A rally to x=155^12 would trigger an appealing ‘mechanical’ short. This trade is only for subscribers who understand why ‘x’ is not a support, resistance or a Hidden Pivot. _______ UPDATE (Jan 20, 8:05 p.m.): A vertical spike has hit 155^12 this evening, cueing up the short noted above. On the 15-minute chart, use a reverse pattern where a= 154^19 (Jan 19, at 2:30 p.m. EST) to create an entry trigger. Your theoretical risk initially would be about $250/contract. You’ll be on your own if the expected downturn hits the first profit-taking threshold at 154^30. _______ UPDATE (Jan 21, 9:31): The trade triggered twice last night, and one European subscriber reported exiting in the middle of New York’s night with a profit. However, I’ll record this one as a scratch, with no gain or loss, since it took guts, savvy and agility to manage the trade. All of it had to have been covered at the red line, since a subsequent rally pushed the futures to new recovery highs.

USH22 – March T-Bonds (Last:155^23)