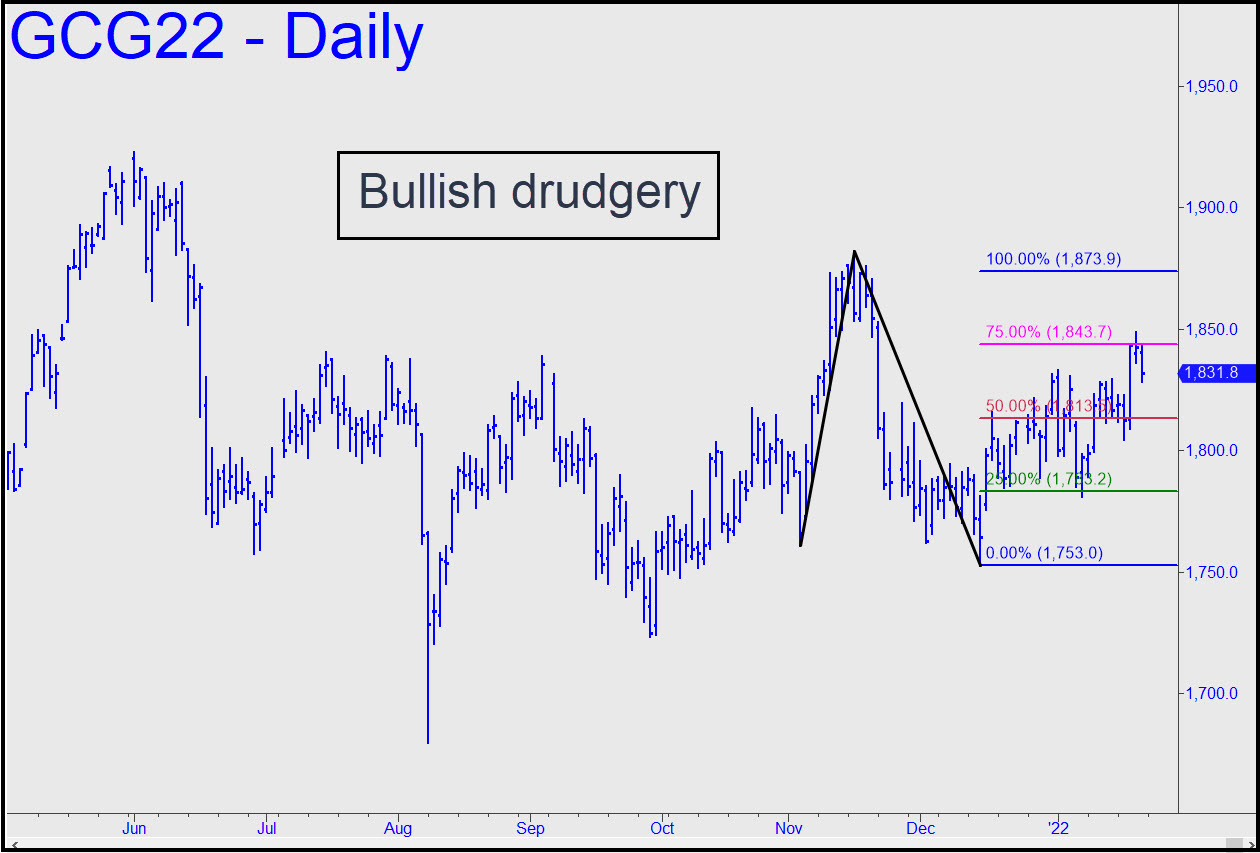

The rally has been unimpressive, but it is inarguably getting the job done. We’ve been using the pattern shown, with an 1873.90 target, to stay on the right side of a challenging trend. It has helped us to avoid disappointment whenever gold dives from somewhere shy of a minor target, but also to spot money-making opportunities on the way up, including a recent $8000 winner that had been explicitly detailed here. A similar opportunity would be signaled via a ‘mechanical’ buy if the futures were to fall to p=1813.50 (the red line in the chart). The appropriate stop-loss would be at 1793.30, implying $8,000 of entry risk on four contracts, but we’ll find a less stressful way to get aboard if and when the opportunity comes. ______ UPDATE (Jan 26, 9:16 p.m.): If today’s gratuitous, stage-managed plunge continues, it will trip a ‘mechanical’ buy at x=1783.20, stop 1752.00. Don’t bother with this one unless you are proficient enough with rABC ‘camo’ setups to cut the implied $12,000 entry risk on four contracts to no more than a tenth of that.

The rally has been unimpressive, but it is inarguably getting the job done. We’ve been using the pattern shown, with an 1873.90 target, to stay on the right side of a challenging trend. It has helped us to avoid disappointment whenever gold dives from somewhere shy of a minor target, but also to spot money-making opportunities on the way up, including a recent $8000 winner that had been explicitly detailed here. A similar opportunity would be signaled via a ‘mechanical’ buy if the futures were to fall to p=1813.50 (the red line in the chart). The appropriate stop-loss would be at 1793.30, implying $8,000 of entry risk on four contracts, but we’ll find a less stressful way to get aboard if and when the opportunity comes. ______ UPDATE (Jan 26, 9:16 p.m.): If today’s gratuitous, stage-managed plunge continues, it will trip a ‘mechanical’ buy at x=1783.20, stop 1752.00. Don’t bother with this one unless you are proficient enough with rABC ‘camo’ setups to cut the implied $12,000 entry risk on four contracts to no more than a tenth of that.

GCG22 – February Gold (Last:1813.70)