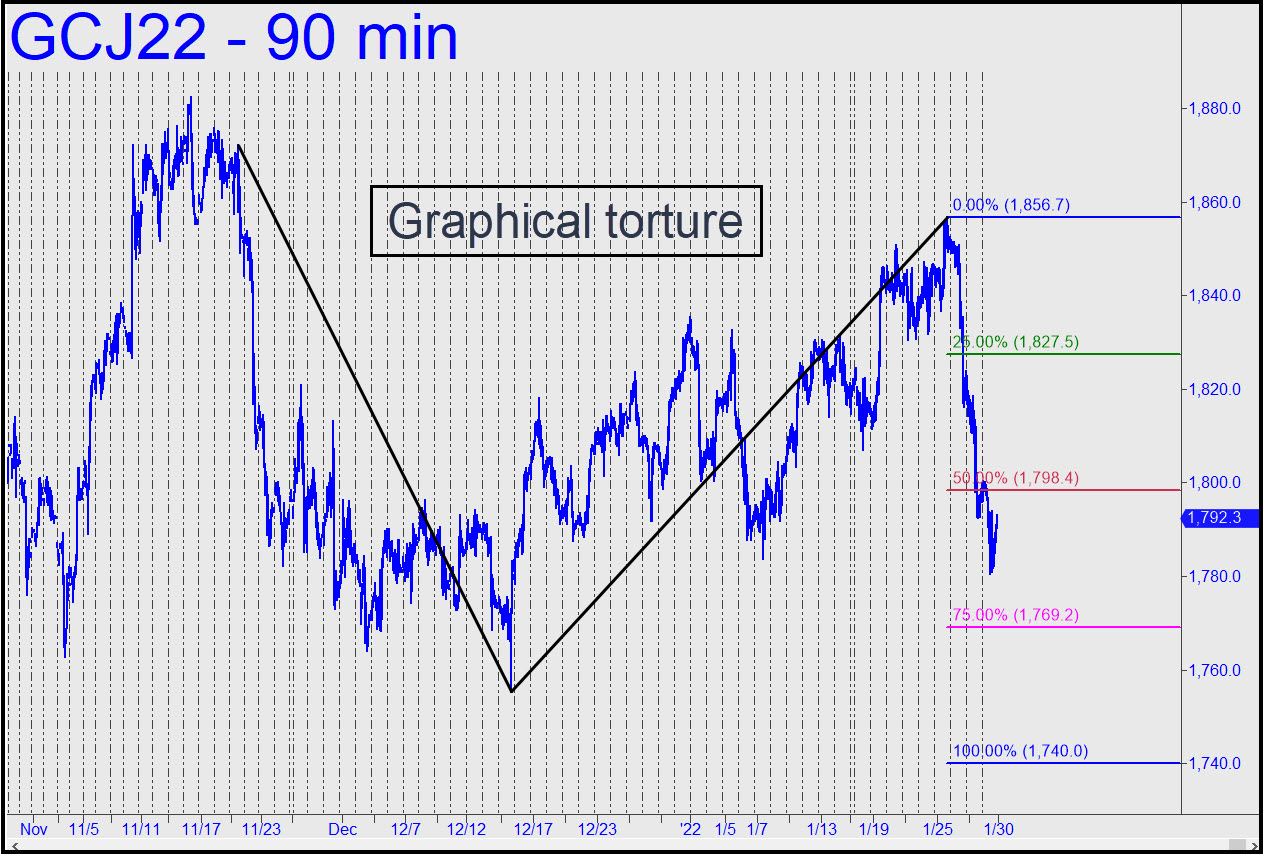

The tortuous pattern shown should be serviceable for now, although we have come to expect gold’s nasty, gratuitous dives to fall short of their ‘D’ targets — in this case 1740.00. The p2 secondary pivot (p2) at 1769.20 is another matter, however, and it should be used to attempt bottom-fishing with a tight stop-loss. Specifically, I’ll suggest managing the trade with a reverse pattern where a=1836.80 on 1/25 at 6:00 a.m. EST. Theoretical entry risk will be around $500 per contract, so this one is not recommended for novices. _______ UPDATE (Feb 4, 8:22 a.m.): Gold’s moves in either direction are 100% gratuitous but tradeable nonetheless. Although the April contract failed to dip to the secondary pivot where we’d planned to do some bottom-fishing, the current rally will become ‘mechanically’ shortable if and when it touches x=1826.60. With about $12,000 of theoretical entry risk on four contracts, this gambit calls for a deft ‘camouflage’ touch. Here’s the chart.

The tortuous pattern shown should be serviceable for now, although we have come to expect gold’s nasty, gratuitous dives to fall short of their ‘D’ targets — in this case 1740.00. The p2 secondary pivot (p2) at 1769.20 is another matter, however, and it should be used to attempt bottom-fishing with a tight stop-loss. Specifically, I’ll suggest managing the trade with a reverse pattern where a=1836.80 on 1/25 at 6:00 a.m. EST. Theoretical entry risk will be around $500 per contract, so this one is not recommended for novices. _______ UPDATE (Feb 4, 8:22 a.m.): Gold’s moves in either direction are 100% gratuitous but tradeable nonetheless. Although the April contract failed to dip to the secondary pivot where we’d planned to do some bottom-fishing, the current rally will become ‘mechanically’ shortable if and when it touches x=1826.60. With about $12,000 of theoretical entry risk on four contracts, this gambit calls for a deft ‘camouflage’ touch. Here’s the chart.

GCJ22 – April Gold (Last:1815.70)