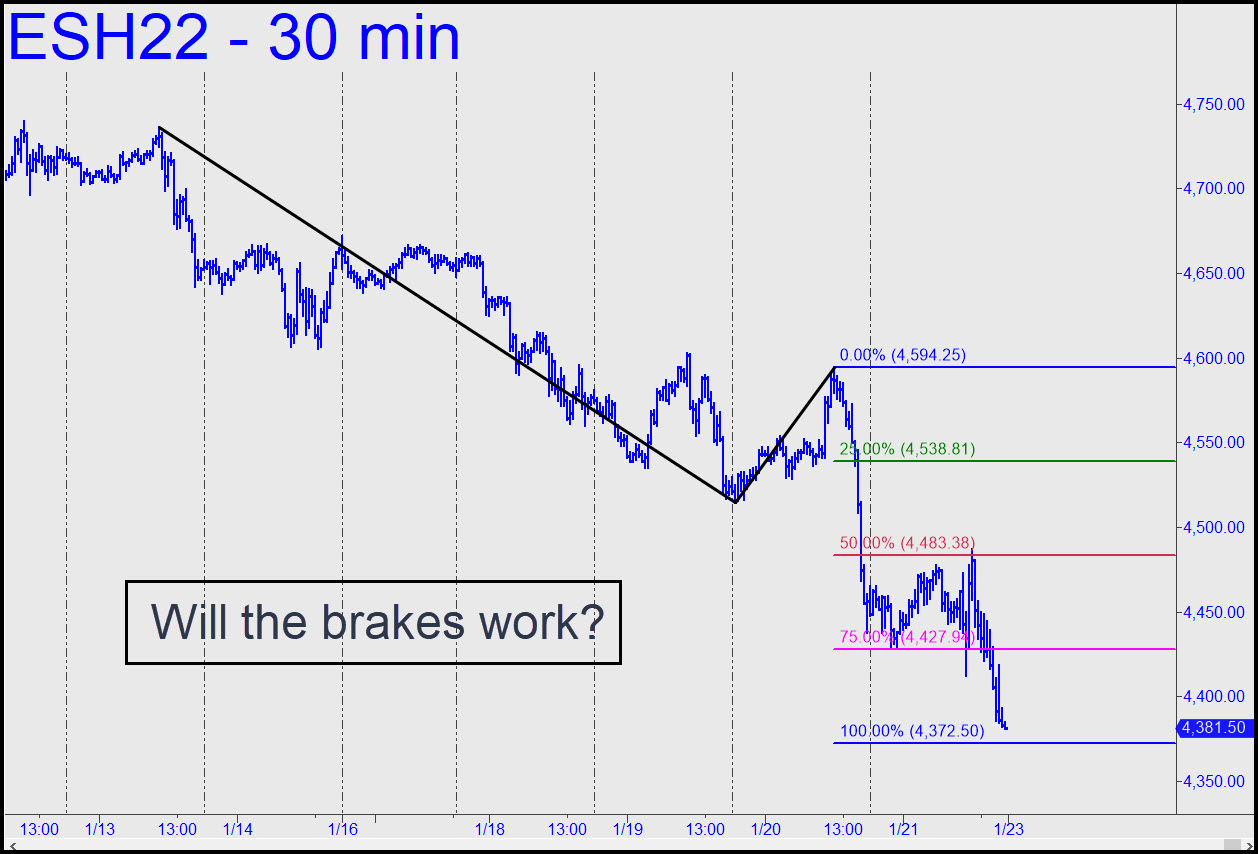

Buyers caved after failing to get much boost from a rigged opening. Sellers were played to exhaustion an hour into the session, but when the obligatory short squeeze sputtered out before lunch, the game was over for bulls. The surprise was that the downtrend in the final hour failed to hold a promising Hidden Pivot support. This put the futures on track to hit the 4372.50 target shown in the chart. This would ordinarily be a can’t-lose place to try bottom-fishing intraday, but not on a Sunday evening if the futures open weak. That would waste an especially opportune ‘gnarly’ pattern, but as we know, there will always be another. Following a decisive breach of ‘D’, the next logical stop on the southbound express would be 4305.25, derived from converting point ‘C’ on the chart into ‘A’ of the new pattern.

Buyers caved after failing to get much boost from a rigged opening. Sellers were played to exhaustion an hour into the session, but when the obligatory short squeeze sputtered out before lunch, the game was over for bulls. The surprise was that the downtrend in the final hour failed to hold a promising Hidden Pivot support. This put the futures on track to hit the 4372.50 target shown in the chart. This would ordinarily be a can’t-lose place to try bottom-fishing intraday, but not on a Sunday evening if the futures open weak. That would waste an especially opportune ‘gnarly’ pattern, but as we know, there will always be another. Following a decisive breach of ‘D’, the next logical stop on the southbound express would be 4305.25, derived from converting point ‘C’ on the chart into ‘A’ of the new pattern.

ESH22 – March E-Mini S&P (Last:4381.50)