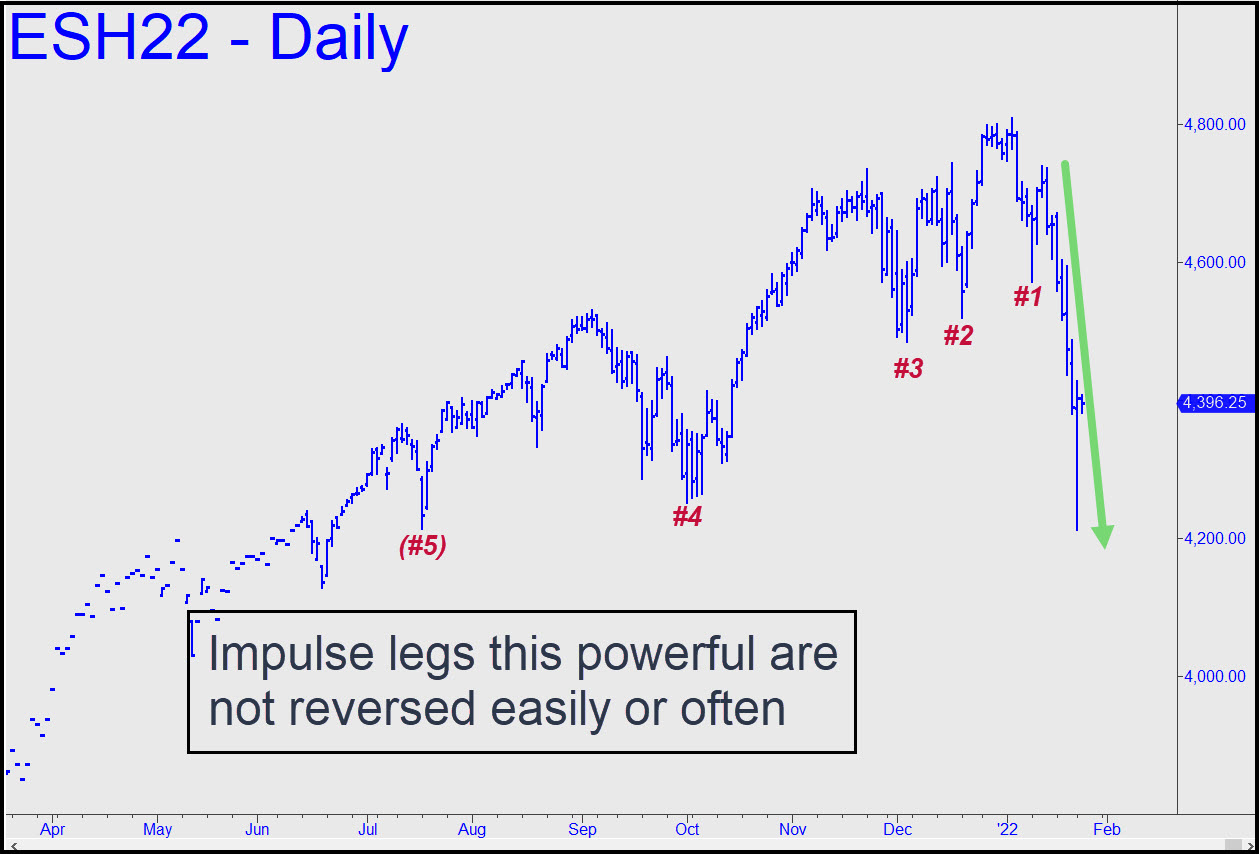

Bears were probably more frightened than bulls when Monday’s carnage ended. The final half-hour of the session featured an 80-point rally so steep that it would have left shorts too dazed to stand their ground. However, the bigger picture suggests cyclical forces may finally be on their side. It features an 11% drop in the S&Ps over the last eight days that exceeded no fewer than five prior lows. This is a quite powerful impulse leg, and it is how we might expect a bear market to begin. For now, though, it seems highly unlikely to be quickly undone by short covering, let alone by bulls eager to buy the dip. This time, many of them will doubtless be praying for an opportunity to exit at at least somewhat higher prices rather than salivating over the prospect of going all-in on further weakness. This doesn’t mean things will get any easier for bears, who may be sensing a chance, finally, to make some real money. Regardless, whatever opportunities arise will be reducible to the common denominator of the Hidden Pivot Method: impulse legs. Stay tuned if you want to see how we make sense of them and trade them, no matter how nutty stocks get. _______ UPDATE (Jan 25, 10:23 p.m.): ‘Mechanical’ trades work best in violent markets, especially when the entry looks scary. Check out this evening’s chat room gambit involving a bet against a nasty after-hours sell-off. It produced a quick winner worth at least $1,700 per contract. _______ UPDATE (Jan 26, 9:10 p.m.): The night shift dirtballs can’t always steal with impunity. Tonight, for instance, although they have pulled their bids in order to see where sellers exhaust themselves, they must still be on their guard for an onslaught of market orders at the opening. Use p2=4240.50 in this chart as a minimum downside objective for now and a place to attempt ‘camo’ bottom-fishing. Any slippage below the pivot would portend more weakness to D=4172.00.

Bears were probably more frightened than bulls when Monday’s carnage ended. The final half-hour of the session featured an 80-point rally so steep that it would have left shorts too dazed to stand their ground. However, the bigger picture suggests cyclical forces may finally be on their side. It features an 11% drop in the S&Ps over the last eight days that exceeded no fewer than five prior lows. This is a quite powerful impulse leg, and it is how we might expect a bear market to begin. For now, though, it seems highly unlikely to be quickly undone by short covering, let alone by bulls eager to buy the dip. This time, many of them will doubtless be praying for an opportunity to exit at at least somewhat higher prices rather than salivating over the prospect of going all-in on further weakness. This doesn’t mean things will get any easier for bears, who may be sensing a chance, finally, to make some real money. Regardless, whatever opportunities arise will be reducible to the common denominator of the Hidden Pivot Method: impulse legs. Stay tuned if you want to see how we make sense of them and trade them, no matter how nutty stocks get. _______ UPDATE (Jan 25, 10:23 p.m.): ‘Mechanical’ trades work best in violent markets, especially when the entry looks scary. Check out this evening’s chat room gambit involving a bet against a nasty after-hours sell-off. It produced a quick winner worth at least $1,700 per contract. _______ UPDATE (Jan 26, 9:10 p.m.): The night shift dirtballs can’t always steal with impunity. Tonight, for instance, although they have pulled their bids in order to see where sellers exhaust themselves, they must still be on their guard for an onslaught of market orders at the opening. Use p2=4240.50 in this chart as a minimum downside objective for now and a place to attempt ‘camo’ bottom-fishing. Any slippage below the pivot would portend more weakness to D=4172.00.

ESH22 – March E-Mini S&P (Last:4282.75)