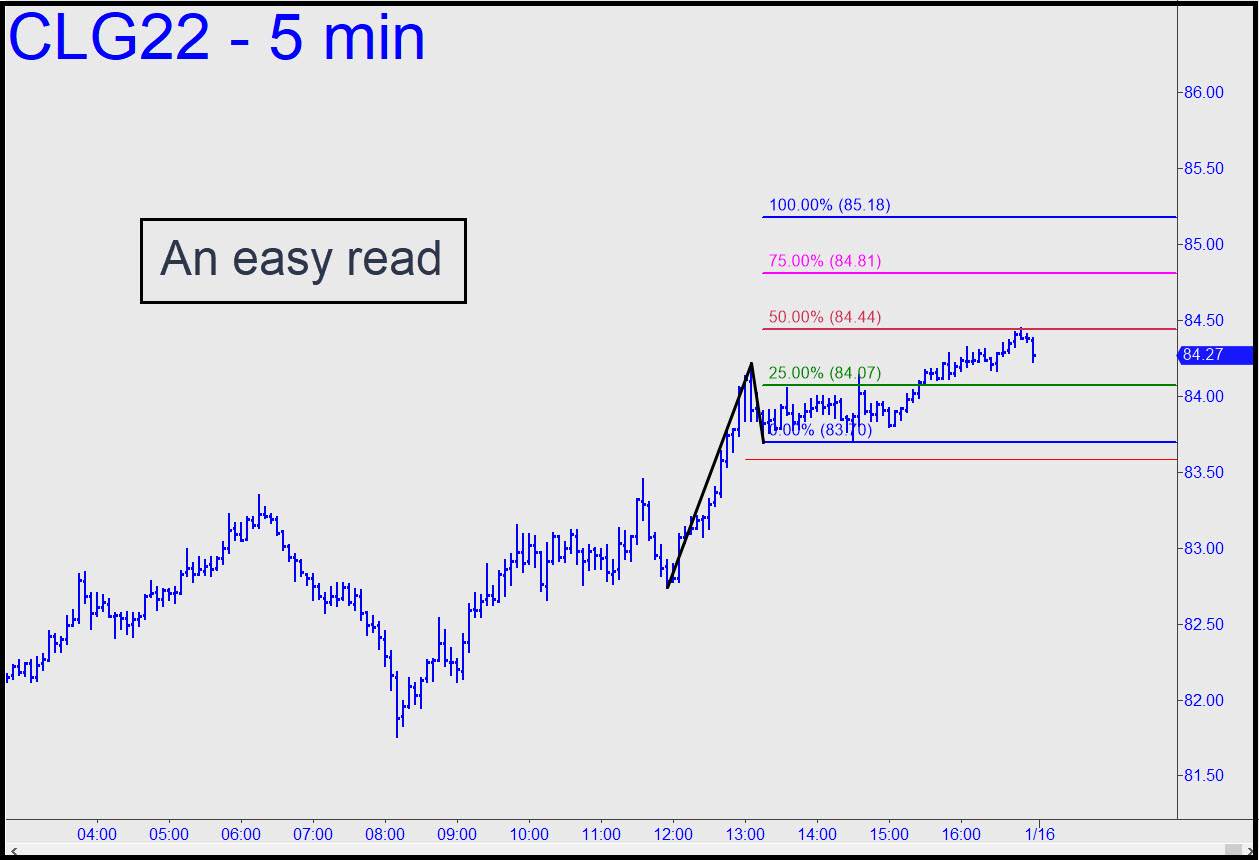

We took an $840 loss shorting four contracts on the rise Friday, learning in the process something we’d already suspected: that this rally is probably going much higher. A titanium Hidden Pivot resistance at 83.87 that had taken five months to achieve showed no discernible resistance, telegraphing the session’s strong finish. Since $100 crude seems fated, we’ll focus for now on the smaller, tradeable patterns that will get it there. The one shown would trip a theoretical ‘mechanical’ buy on a pullback to the green line (x=84.07), but I am not explicitly recommending the trade, since it could occur over the weekend. If and when buyers punch through p=84.44, we should look for a follow-through to at least 85.18, a place to get short if you’ve made some bucks on the way up. ______ UPDATE (Jan 17, 9:48 a.m. EST): In the chat room last night two subscribers reported jumping on the trade detailed above. However, since neither said anything about he got aboard, nor about risk management thereupon, I cannot say whether they may have throw caution to the wind. Here’s a chart that shows why the $1,480 profit the trade would have produced at p=84.44 came with almost no pain, since the futures never dipped more than two ticks below the 84.07 entry price. However, they fell in the middle of the night after trading slightly above p, and so the question of how one managed the ongoing risk would determine the amount of the eventual gain. If at least half of the position was exited at p but the rest is STILL held, the net gain is still around $500. FYI, here’s a chart for the March contract with a visually logical target at 88.13. A pullback to the red line (75.09) could be bought ‘mechanically’ if you are familiar with the technique. _______ UPDATE (Jan 20, 8:26 p.m.): Tonight’s bloody carnage in crude is certainly refreshing, but energy users counting on a respite from the relentless rise in fuel prices shouldn’t get their hopes up, at least not yet. The magnitude of this evening’s drop suggests that a corresponding selloff in shares is being caused by mounting fears of a global economic downturn. In the past, such fears were quickly dispelled by stock-market rallies that were NEVER more than two days away. However, stocks may have entered a bear market, and so a snap-back rally in crude is hardly assured. We’ll watch both closely in the days ahead, the better to determine whether a major, bearish shift is occurring in investor psychology, as appears to be the case. _______ UPDATE (Jan 21, 10:30 a.m.): March crude is descending to a midpoint support at 83.61 that can be bottom-fished with a ‘camouflage’ trigger. Here’s the chart.

We took an $840 loss shorting four contracts on the rise Friday, learning in the process something we’d already suspected: that this rally is probably going much higher. A titanium Hidden Pivot resistance at 83.87 that had taken five months to achieve showed no discernible resistance, telegraphing the session’s strong finish. Since $100 crude seems fated, we’ll focus for now on the smaller, tradeable patterns that will get it there. The one shown would trip a theoretical ‘mechanical’ buy on a pullback to the green line (x=84.07), but I am not explicitly recommending the trade, since it could occur over the weekend. If and when buyers punch through p=84.44, we should look for a follow-through to at least 85.18, a place to get short if you’ve made some bucks on the way up. ______ UPDATE (Jan 17, 9:48 a.m. EST): In the chat room last night two subscribers reported jumping on the trade detailed above. However, since neither said anything about he got aboard, nor about risk management thereupon, I cannot say whether they may have throw caution to the wind. Here’s a chart that shows why the $1,480 profit the trade would have produced at p=84.44 came with almost no pain, since the futures never dipped more than two ticks below the 84.07 entry price. However, they fell in the middle of the night after trading slightly above p, and so the question of how one managed the ongoing risk would determine the amount of the eventual gain. If at least half of the position was exited at p but the rest is STILL held, the net gain is still around $500. FYI, here’s a chart for the March contract with a visually logical target at 88.13. A pullback to the red line (75.09) could be bought ‘mechanically’ if you are familiar with the technique. _______ UPDATE (Jan 20, 8:26 p.m.): Tonight’s bloody carnage in crude is certainly refreshing, but energy users counting on a respite from the relentless rise in fuel prices shouldn’t get their hopes up, at least not yet. The magnitude of this evening’s drop suggests that a corresponding selloff in shares is being caused by mounting fears of a global economic downturn. In the past, such fears were quickly dispelled by stock-market rallies that were NEVER more than two days away. However, stocks may have entered a bear market, and so a snap-back rally in crude is hardly assured. We’ll watch both closely in the days ahead, the better to determine whether a major, bearish shift is occurring in investor psychology, as appears to be the case. _______ UPDATE (Jan 21, 10:30 a.m.): March crude is descending to a midpoint support at 83.61 that can be bottom-fished with a ‘camouflage’ trigger. Here’s the chart.

CLG22 – February Crude (Last:84.33)