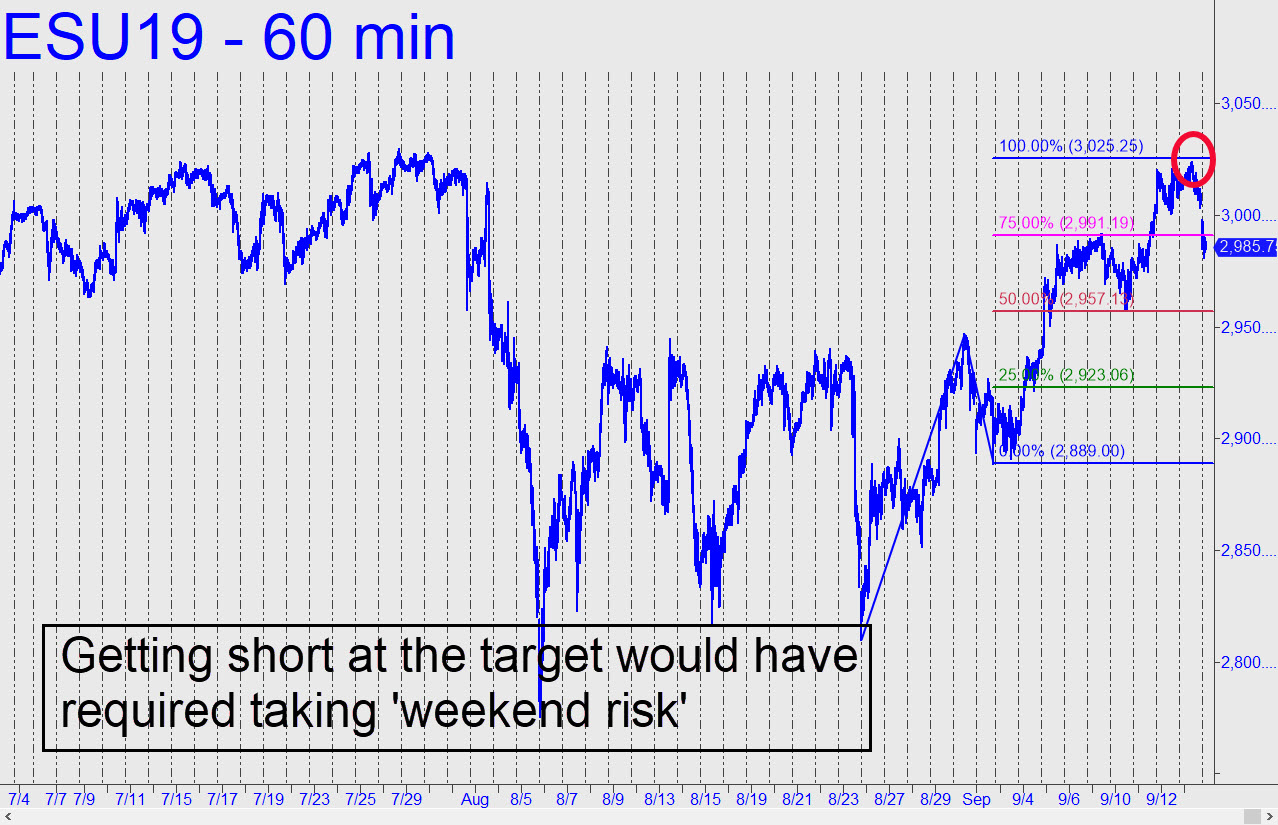

As we might have expected, getting short at an enticing rally target proved more difficult than it sounded. The position would have faced ‘weekend risk,’ requiring us to trust that Trump would not be tweeting up a bullish storm about the trade talks. Instead, Iran bombed a Saudi oil facility, causing a global selloff in stocks. The odd thing is, the selloff seems to have abated at the moment without ever having become an avalanche. Perhaps those who have yet to panic don’t understand the situation? Regardless, we’ll step back for now to see whether the selloff gets legs. We should resist the urge to buy anything in the meantime, since there’s no way this very real crisis will simply melt away. _______ UPDATE (Sep 16, 8:55 p.m. ET): The futures gave up little ground following troubling news, suggesting that the bullish rampage begun in the last week of August has farther to go. We’ll try to get short if this vehicle moves into record territory, but for now just spectate. ______ UPDATE (Sep 17, 5:45 p.m.): With the futures just inches from new record highs, I am unable to give you a clear target at the moment. I am somewhat skeptical of the rally, however, and can offer this chart to show you how to get short using an rABC pattern. It is intended for night owls, with a set-up that would apply to the December contract if it spikes into the 3010-3012 range and pulls back to the green line. (Note: Don’t even think about this trade unless you understand how rABC set-ups work. They have been the chief substance of Wednesday tutorial sessions for the last couple of months.)

As we might have expected, getting short at an enticing rally target proved more difficult than it sounded. The position would have faced ‘weekend risk,’ requiring us to trust that Trump would not be tweeting up a bullish storm about the trade talks. Instead, Iran bombed a Saudi oil facility, causing a global selloff in stocks. The odd thing is, the selloff seems to have abated at the moment without ever having become an avalanche. Perhaps those who have yet to panic don’t understand the situation? Regardless, we’ll step back for now to see whether the selloff gets legs. We should resist the urge to buy anything in the meantime, since there’s no way this very real crisis will simply melt away. _______ UPDATE (Sep 16, 8:55 p.m. ET): The futures gave up little ground following troubling news, suggesting that the bullish rampage begun in the last week of August has farther to go. We’ll try to get short if this vehicle moves into record territory, but for now just spectate. ______ UPDATE (Sep 17, 5:45 p.m.): With the futures just inches from new record highs, I am unable to give you a clear target at the moment. I am somewhat skeptical of the rally, however, and can offer this chart to show you how to get short using an rABC pattern. It is intended for night owls, with a set-up that would apply to the December contract if it spikes into the 3010-3012 range and pulls back to the green line. (Note: Don’t even think about this trade unless you understand how rABC set-ups work. They have been the chief substance of Wednesday tutorial sessions for the last couple of months.)

ESZ19 – December E-Mini S&P (Last:3008.20)