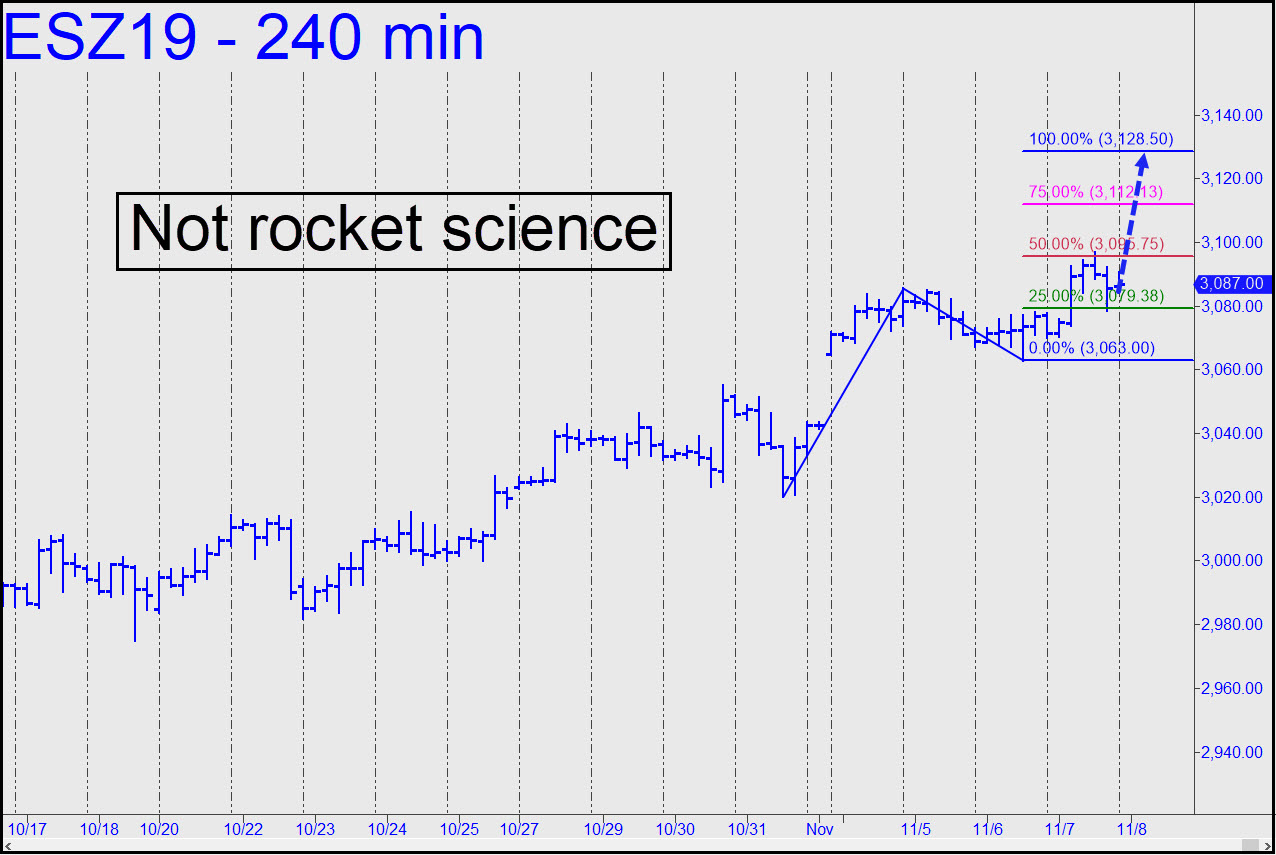

The Morning Line commentary for today references a 3107 trendline target for this vehicle, but we may be able to come up with a more precise top using Hidden Pivots. The trendline connects two peaks, but with an alternative second peak that would raise the trendline shown by about six points to around 3113. It is rising with a slope of about $3 per day. Now here’s where the analysis gets interesting. The Hidden Pivot chart (see inset) projects a target at 3128.50 that has been validated by today’s precise pullback from p=3097.75. This implies that if and when the futures close above p, or trade more than a few points above it intraday, they will become a good bet to reach 3128.50 exactly. If it happens on Wednesday, that would be in nearly perfect alignment with the trendline. ______ UPDATE (Nov 13, 4:20 p.m.): The trendline will come in Thursday at around 3121, which is certainly not out of reach. Be ready to get short there, but if you’d prefer to buy put options instead, use 311.80 as a target in DIA. It is tied to the same trendline. _______ UPDATE (Nov 14, 8:05 p.m.): The trendline will come in at around 3125.00 on Friday. Putting the DIA trendline target aside, there’s a Hidden Pivot target at 280.88 that you could short with a very tight stop-loss. Here’s the chart.

The Morning Line commentary for today references a 3107 trendline target for this vehicle, but we may be able to come up with a more precise top using Hidden Pivots. The trendline connects two peaks, but with an alternative second peak that would raise the trendline shown by about six points to around 3113. It is rising with a slope of about $3 per day. Now here’s where the analysis gets interesting. The Hidden Pivot chart (see inset) projects a target at 3128.50 that has been validated by today’s precise pullback from p=3097.75. This implies that if and when the futures close above p, or trade more than a few points above it intraday, they will become a good bet to reach 3128.50 exactly. If it happens on Wednesday, that would be in nearly perfect alignment with the trendline. ______ UPDATE (Nov 13, 4:20 p.m.): The trendline will come in Thursday at around 3121, which is certainly not out of reach. Be ready to get short there, but if you’d prefer to buy put options instead, use 311.80 as a target in DIA. It is tied to the same trendline. _______ UPDATE (Nov 14, 8:05 p.m.): The trendline will come in at around 3125.00 on Friday. Putting the DIA trendline target aside, there’s a Hidden Pivot target at 280.88 that you could short with a very tight stop-loss. Here’s the chart.

ESZ19 – December E-Mini S&P (Last:3107.00)